Implementing Generative AI in Finance and Banking Sector

Explore the transformative impact of Generative AI in the finance and banking industry. From revolutionizing compliance and customer service to streamlining operations and bolstering sales, discover how Gen AI's multifaceted capabilities are reshaping the industry.

A vast majority of financial service providers are familiar with AI/ML technologies. They have been harnessing these technologies to gauge the trade trajectory, scan vast amounts of crucial financial data to predict businesses' futures, and more. However, with the introduction of Generative AI, the financial industry might be in for a major transformation. The technology is capable of understanding human languages and, based on that understanding, creating new output or responses.

In the realm of banking, the technology is tipped to simplify compliance, expedite software product development, add quality and efficiency to customer support services, and facilitate product/service promotion through personalized messaging.

These capabilities are tough to ignore, a fact clearly underscored by Google Cloud Gen AI Benchmarking Study, July 2023, in which 82% of banking and financial firms are either considering or already using Generative AI in some ways to drive quality and efficient outcomes in their banking operations.

Benefits of Generative AI in Finance and Banking Operations

-

Improved Client Interactions

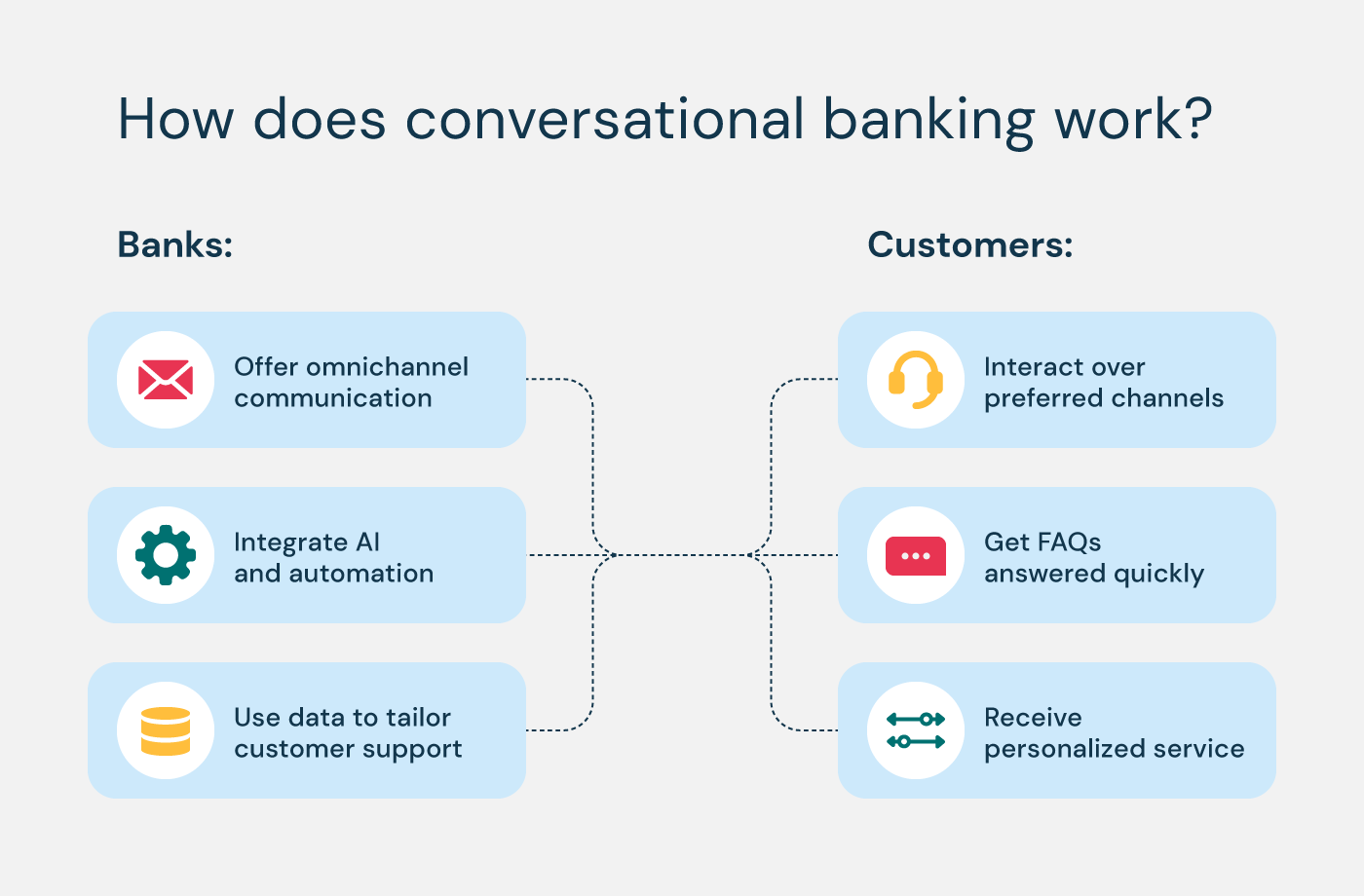

Generative AI has a major role to play in improving client interactions. Financial service providers have to deal with vast amounts of clients' data spread across emails and documents in no particular order.

That's where Generative AI comes in. It can easily scan through that 'data rubble' and gain a comprehensive understanding of the clientele.

This understanding can later be leveraged to drive personalized interactions with clients and pitch different product/service offerings based on identified tastes and preferences using AI-driven chat assistants.

Source - Sinch

-

Improved Efficiency & Productivity

The benefit extends to all aspects of banking and finance where manual effort is needed. Generative AI, with its ability to learn from experience (training with new data), can produce results that resemble or, at times, far exceed those achieved by humans in super quick time. Think of software development.

Generative AI offers code-assistants that are incredibly good at cross-language translation(think Java to .NET), bug reporting, and resolution and can halve the time spent in many code releases.

That's not all. Generative AI, with its ability to churn meaningful content in minutes, is also being leveraged to write all types of documents, viz. finance, environment, social, governance, and audit reports. In some instances, it's even been used to write loan contracts like mortgages.

These are just a few examples of how Generative AI can inject a definite boost of efficiency and productivity into financial institutions. More advanced areas of application are being identified to redefine banking as it exists.

-

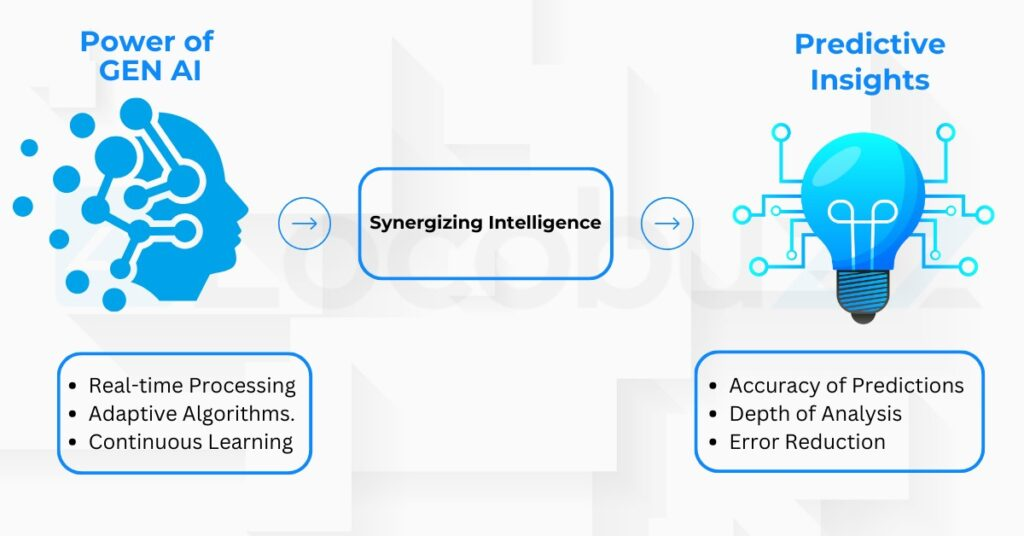

Drive Decision Making Through Intelligent Forecasting

Generative AI is capable of analyzing large databases, and that incredible ability enables it to make highly accurate predictions. For financial institutes, the possibilities are endless. They can train their Generative AI model on corporate action or security filings to predict the path a business is headed towards. Investment firms can use it to predict stock prices, exchange rates, portfolio optimization, and even fraud detection.

Source - Locobuzz

-

Enhanced Savings & Revenue

By automating much of the manual work and by injecting the accelerator effect, Generative AI can deliver massive value in terms of savings and revenue increase to financial institutions.

McKinsey Global Institute predicts that across the whole banking spectrum, including wholesale and retail, Generative AI could add anywhere between $200 to $340 in value largely by driving greater productivity.

Use Cases and Application of Generative AI in Finance and Banking Operations

-

Fraud Detection And Risk Assessment

Financial fraud continues to plague economies around the world. As per a report from the Association of Certified Fraud Examiners, as much as 5 percent of corporate revenue is lost to fraud each year - that comes to $4.5 trillion globally. There's no escaping the fact that financial firms spend enormous resources and mechanisms to counter fraud. Generative AI could have a role to play in that act.

The technology is perfect for analyzing large data sets, analyzing patterns, and detecting any anomalies. Moreover, it can create comprehensive client profiles that specify users' preferred payment methods, spending, and withdrawal patterns. A system trained with this kind of data can immediately come to the rescue the moment fraudulent or suspicious activity is detected. Here are some highlights from the financial services firms leveraging Generative AI for fraud detection:

# PayPal: Implemented a global real-time fraud detection system, leveraging NVIDIA GPU-powered inference, resulting in a 10% enhancement in fraud detection while reducing server capacity by nearly 8x.

# Swedbank: Utilized NVIDIA GPU-driven generative adversarial networks to detect suspicious activities, preventing fraud and money laundering, saving $150 million in a single year.

Tapping into those same large datasets and analyzing various factors like credit scores, transaction history, market trends, and economic indicators, the Gen AI models can determine the possibility of a potentially risky investment. Financial professionals can then act on those alerts to assess, mitigate, and improve their decision-making both for the present and future scenarios.

-

Trading & Portfolio Management

When it comes to trading and portfolio management, the more information one has, the better. This is especially true when the deal involved is of a larger magnitude. Think Asset Management Funds’ Fund Manager. From historical returns, the company's current financial health, how long it's been around, how it stacks up against its competitors, and the list goes on. Generative AI can help Fund Managers with all the data they need to make intelligent decisions while managing risk and driving maximized returns for the fund.

Gen AI tools can put together a cluster of information vital to one's portfolio by quickly analyzing returns and recent mentions of unpopular companies. This helps traders not miss out on these potential runaways and share in their growth by making intelligent investing decisions. That's just one instance of Generative AI's ability to manage portfolios in some new way.

Embrace the Future of Banking: Harness Generative AI Today!

Revolutionize Your Operations with Cutting-edge Generative AI Solutions.

-

Compliance And Regulatory Change Monitoring

Generative AI can play a vital role in simplifying the compliance and regulatory process across banking and finance firms. The technology can analyze complex regulatory documents and create a synopsis for junior compliance officers’ understanding. Since regulations change from time to time, the technology can be trained to issue alerts for such occasions. Generative AI models are always learning from new data; they can be positioned to deliver improved accuracy, assist in audits, and facilitate employee training.

-

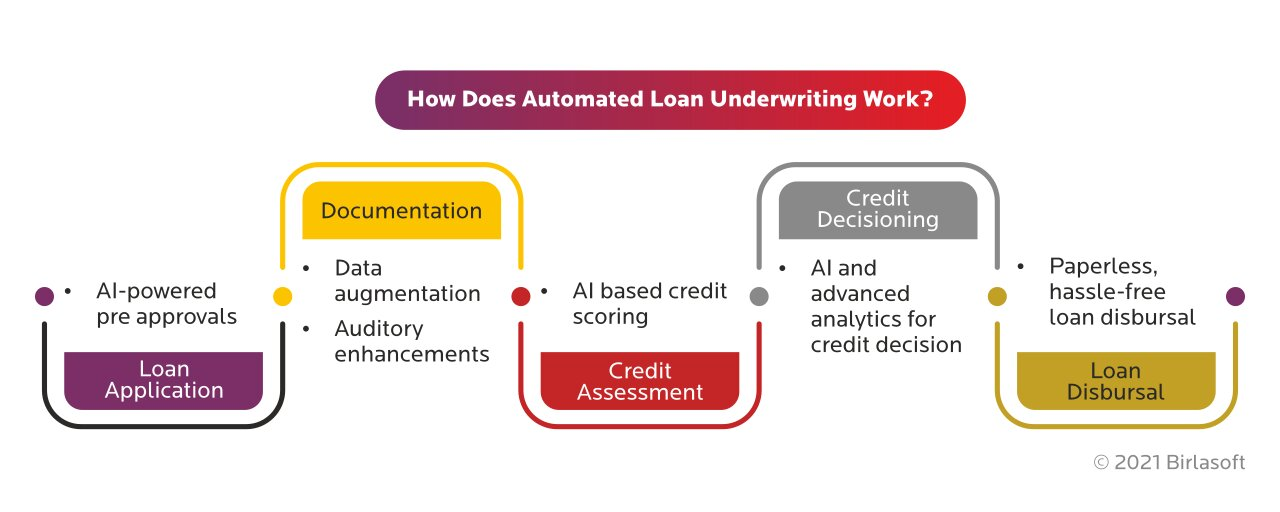

Loan Underwriting and Mortgage Approval

Source - Birlasoft

Some banks are using Generative AI to read the documentation on corporate actions and seek assessment for the implications those actions might have over their clients and products. It doesn't end there.

Generative AI is very much eliminating manual documentation tasks. It's being used to write documents for loan underwriting and mortgage approval. By training the models on synthetic data, the technology can enhance the accuracy of loan underwriting decisions.

This way, Generative AI drives efficiency and elevates the customer experience by automating all the loan processing steps from data entry to approval.

-

Financial Forecasting And Market Analysis

Financial forecasting, if done manually, can be a huge drain on a business's financial resources, and despite that, it remains prone to errors and mistakes. Generative AI is tailor-made for this kind of analysis-intensive work.

Financial planners can train Gen AI models with all the existing company data concerning its financial health and then club it with all the new policies and market trends expected in the future to gain insights into future financial scenarios.

This way, businesses can create sound financial strategies and allocate their resources for optimum utilization. Investment firms go through oceans of data in their bid to understand the pulse of the market.

Often, they find themselves analyzing the company's filings, transcripts, reports, agreements, partnerships, announcements, and so much more to keep their knowledge bases updated. Sounds like a laborious task.

Not with Generative AI. The Gen AI tools are starting to prove their worth as research assistants to investment analysts. They're capable of rapidly sifting through all of the aforementioned data and coming up with key findings and a summary of the analysis.

Challenges & Risks of Generative AI in Financial Services

-

Excessive Energy Expenditure

While on the outset, Generative AI looks like the perfect technology for all of the financial industry's woes, it does have its downsides. The technology is resource-hungry. Running complex algorithms and gen AI models call for a surplus pool of energy. This often implies huge cost spending and taxing of other internal resources. This is one major reason we don't see all banking and financial firms adopting the technology at the same pace.

-

Input Quality Reciprocates Output Quality

The quality of responses of your model directly depends on the quality of data you train it with. It's just as simple as that. In financial decisions, a poorly constructed database can be a recipe for disaster; think major financial loss, loss of public trust, and general disrepute. That's why it's crucial to vet the data several times, obtain approval from all stakeholders, and look to mitigate the risk as much as possible.

-

Risk of Cybersecurity

Since the Gen AI models are dealing with vast amounts of sensitive and confidential information, they remain prone to attacks from hackers. Should there be a security breach, all of that sensitive information could get into the wrong hands, and there's every possibility of financial fraud. That's why it's vital to continuously check the security risks and follow standard industry protocols to safeguard that data.

-

Governance & Regulatory Compliance

Generative AI is still a bit of a mystery in terms of its real potential, and that's why it comes with an additional challenge of Government and Regulatory Compliance. There's an onus on all Generative AI users to ensure their actions comply with the standard industry guidelines. For many financial or banking firms, some of these additional compliances could be too much to handle.

Strategy For Implementing Generative AI Into Processes And Systems

Financial firms can systematically integrate Generative AI technology into their operations, leveraging its capabilities to enhance efficiency, improve decision-making, and stay competitive in the evolving landscape of finance and banking.

Here are some steps they can follow to make that journey easier:

-

Build a team and train talent for AI Adoption:

Initiate by assembling a multidisciplinary team consisting of data scientists, AI experts, domain specialists, and IT professionals. Training programs, workshops, and certifications can equip existing talent with the necessary skills to understand, implement, and leverage Generative AI effectively within the firm's context.

-

Learn From Other Firms' Success Stories:

Study success stories and case studies from similar financial firms that have successfully integrated Generative AI. Analyze their strategies, challenges faced, and the benefits accrued. Tailor these insights to your firm’s unique needs, considering factors like scale, compliance requirements, and customer base.

-

Provide necessary support to your IT Team:

Ensure continuous support for your IT team. Provide access to resources, tools, and training necessary to adapt to and troubleshoot AI technologies effectively. Encourage collaboration between IT and business units to align technological advancements with organizational goals.

-

Bring A Mindset Shift In Your Organization To Embrace Gen AI:

Foster a culture of innovation and openness to change. Communicate the value and potential of Generative AI across all levels of the organization, highlighting how it can enhance processes, improve decision-making, and drive business outcomes. Encourage experimentation and an environment where learning from failures is embraced.

-

Pilot Programs:

Begin with pilot programs or small-scale implementations to test the viability and effectiveness of Generative AI within specific departments or processes. This allows for iterative improvements, validation of concepts, and identification of potential challenges in a controlled environment before wider implementation.

Real-World Examples of Generative AI in Finance and Banking

The following examples illustrate the diverse applications of Generative AI across various banking and finance landscapes, showcasing its potential to enhance operational efficiency, improve decision-making, and deliver more personalized services to clients.

- Wells Fargo: Beyond using Dialog Flow for their virtual assistant, Fargo's utilization of a large language model (LLM) showcases their commitment to regulatory compliance. By leveraging LLM, they ensure that clients understand the information required by regulators, streamlining the process and reducing potential errors or misunderstandings. This adoption demonstrates how AI can facilitate clearer communication between clients and regulatory bodies in a highly regulated industry.

- Mizuho: Mizuho's trial with Fujitsu’s generative AI technology illustrates their focus on optimizing systems maintenance and development. By leveraging AI, they aim to streamline these critical processes, potentially reducing downtime, enhancing system efficiency, and expediting the deployment of new features or updates. This initiative showcases how AI can revolutionize backend operations in the banking sector.

- Morgan Stanley: The wealth management division’s development of service using OpenAI's GPT-4 technology reflects its commitment to enhancing internal knowledge management. By leveraging advanced AI capabilities, Morgan Stanley seeks to empower employees with quicker access to relevant in-house information across various domains, enabling better decision-making and more efficient client service.

- Goldman Sachs: Goldman Sachs' exploration of generative AI tools for code writing and testing highlights their interest in improving software development processes. By utilizing AI for these tasks, they aim to potentially accelerate coding processes, enhance code quality, and automate certain aspects of testing. This illustrates the potential of AI to optimize software development workflows in financial institutions.

- JP Morgan: The trademark application for IndexGPT suggests JP Morgan's interest in developing an AI-driven financial investment advisor. This tool, if realized, could utilize Generative AI to analyze vast amounts of financial data, potentially providing tailored investment insights and recommendations to clients. This initiative demonstrates how AI can assist in delivering personalized financial advice at scale.

Looking Ahead - Gen AI’s Implications on Finance & Banking Industry

The future of Generative AI in finance and banking holds immense promise, poised to revolutionize the industry across multiple fronts. As technology continues to evolve, AI advancements, especially in generative models, will play a pivotal role in shaping the sector.

With increased sophistication and accuracy, Generative AI will redefine customer experiences by enabling hyper-personalization in financial services, tailoring products and advice to individual needs with unprecedented precision.

Moreover, these AI models will continue to streamline operational efficiency, automating complex tasks and optimizing risk management and compliance procedures.

From predictive analytics for investment decisions to assisting in regulatory compliance and fraud detection, Generative AI will increasingly become an indispensable tool for financial institutions, empowering them to make data-driven decisions swiftly and accurately.

The future landscape is one where Generative AI catalyzes innovation, driving unparalleled efficiency, enhancing customer satisfaction, and ultimately reshaping the very fabric of the finance and banking industry.