Top 9 Benefits of Implementing RPA in Banking and Finance

Uncover how RPA is transforming banking & finance. Boost efficiency, reduce costs, enhance customer experience & automate tasks like mortgage loan processing. Explore RPA's transformative impact on the financial sector.

Did you know, human-error in the banking segment costs approximately $878,000 annually and 25,000 hours of wasteful rework? So it’s no surprise that the banking and financial services want to turn things around, with Gartner predicting a 40% surge in automation adoption by 2027 to tackle this chaos!

Given that the cost of human error in the BFSI segment can be high, adopting robotic process automation seems smart. According to a Mckinsey report, around 60% of occupations can automate over 30% of activities with RPA.

You must probably be wondering which tasks to automate in your banking and financial organization!

Once you have decided on the tasks, how do you start with RPA in banking and finance? Here, we will dive into everything you should know about RPA in banking and finance.

What is Robotic Process Automation in Banking and Finance?

In simple words, RPA helps banks and financial institutions in the digital transformation to automate repetitive manual processes, allowing employees to focus on more crucial tasks, and eventually leading firms to gain a competitive edge and greater customer satisfaction. RPA is a valuable tool to cater to the pressing demands of the banking segment and help them maximize efficiency by minimizing operational costs.

RPA in banking and finance is termed as the use of robotic applications to augment human-efforts.

A basic rule-driven robotic process automation is limited in what it can do. It follows the rules to automate tasks without any changes. For example, it logs into an account, moves files from different folders, and logs out.

But, McKinsey predicts a second wave of automation and Artificial Intelligence, termed Intelligent Automation, in the coming years where software bots and machines will execute 10% to 25% of tasks across a myriad of banking functions, broadening the capacity and simultaneously offering the workforce the opportunity to focus on higher-value tasks and projects.

Note: Here, we’ll use RPA to imply both regular and intelligent process automation.

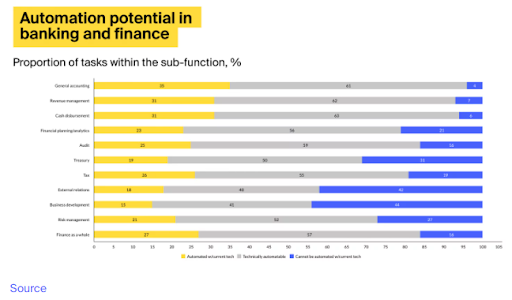

According to a McKinsey report, general accounting operations have the lion’s share of automation in finance. At the same time, business development functions can only be automated up to 56%.

By now, it would be right to say that every industry has found a way to incorporate robotic process automation (RPA) into its workflow, but so far, banking and finance are leading the way.

Why? Because

Investment banks, customer service banks deal, clearing organizations, exchanges and many others are increasingly recognizing the power of automation and the benefits of transforming their business process.

Here’s a quick look at some of the benefits of RPA.

Top 9 Benefits of RPA in Banking and Finance

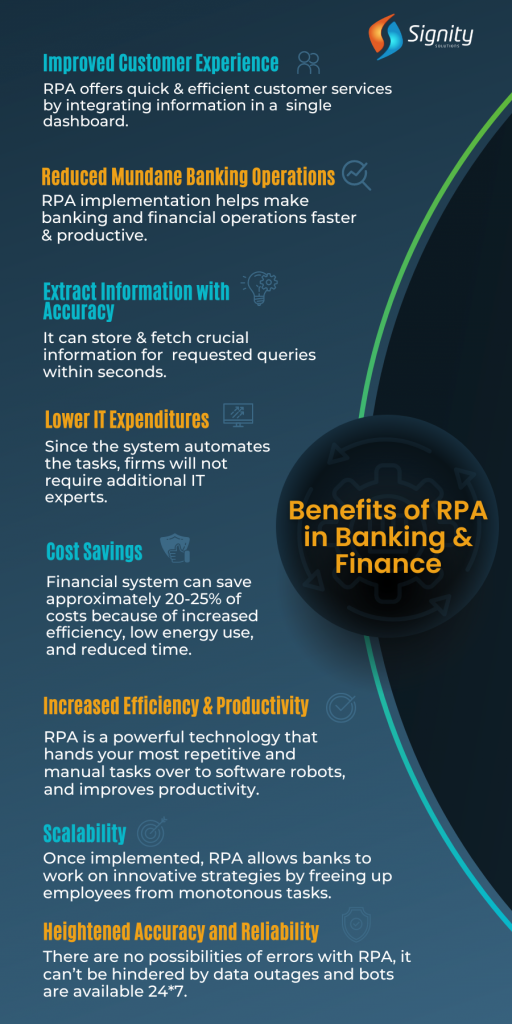

Robotic Process Automation in banking and finance sector offers a wide array of benefits. RPA helps enhance operational efficiency by automating repetitive tasks, reducing processing times, and minimizing delays. From streamlining operations to improving customer experience, RPA is transforming the industry.

According to Gartner, 80% of leaders in the financial sector are already using some form of RPA for various purposes.

Explore the top 9 benefits of implementing RPA in banking and finance, and discover how this technology is driving efficiency, accuracy, and innovation.

Let’s have a look!

Improved Customer Experience

There’s no doubt that positive word-of-mouth can make or break a company’s reputation.

Organizations place special emphasis on the customer experience, and the banking and financial industries are no exception. Unfortunately, working in a busy segment leaves no time for efficient customer service banks and communication.

Here, the RPA system comes into the big picture as it allows banks to incorporate bot technology, which will attentively address customer inquiries and offer suitable solutions to work with customers. The bots also play an important role in automating and processing financial transactions to customer onboarding through mobile apps.

Reduced Mundane Banking Operations

It’s no surprise that banking and financial firms manage voluminous manual processes on a daily basis. Most of them are important and take hours to process. However, organizations simply integrate the RPA system to handle the mundane workload of data transfer and employment verification rather than making the workforce do repetitive tasks.

After all, bots deliver increased productivity compared to full-time human equivalents and can work for 24*7*365 days per year. RPA enables organizations to take the mundane and tedious work away from individuals and redeploy their talents to more analytical and high-value business processes.

Increased Efficiency and Productivity

Another benefit of the RPA system is how it achieves processes effortlessly and swiftly as these systems listen and follow instructions, leaving no room for ambiguity. Unlike manual processes, robotic accounting doesn’t have any shortcomings.

According to Gartner, banking automation can save up to 25,000 hours of avoidable work because of human errors.

Compliance with Regulations and Standards

Banks and the financial industry worldwide have important regulations with which they need to comply. Ensuring regulatory compliance requires two main objectives:

- Aligning business practices to comply with regulations.

- Excellent reporting and record-keeping to prepare for audits.

Fortunately, Robotic Process Automation can mitigate a handful of compliance and auditing pain points. RPA is a powerful technology that hands your most repetitive and manual tasks over to software robots.

Scalability

Robots have high scalability, enabling you to manage high volumes during peak business hours by addressing the need for bots to respond to situations in record time. In addition, RPA implementation allows the bank to focus more on innovative strategies to grow their business by freeing bank employees from doing monotonous tasks.

Cost Savings

Eliminating redundancy and minimizing the need for manual intervention supports that banking and finance firms can exceptionally reduce the added costs they spend on resources, systems, and workforce.

Employees could easily avoid repeating responsibilities like entering new data and scheduling manual processes. Thus, utilizing this technology in the financial system can save approximately 20-25% of costs because of increased efficiency, low energy use, and reduced time.

Lower IT Expenditures

RPAs are not expensive functionalities.

With minimum functionalities, financial organizations, irrespective of their size, can integrate digital systems without requiring skilled IT teams. Often, Robotic software doesn't require exclusive coding knowledge to learn the system's intricacies and operate them optimally.

Since the system automates the tasks, firms will not require additional IT experts.

Heightened Accuracy and Reliability

Human errors are natural to happen. However, in some scenarios, even minimalist mishaps might cause a grave mistake that might cause behemoth losses for the organization. And, in unfortunate circumstances, it might even cost the customers a good reputation.

But don’t worry; these can be easily alleviated by integrating RPA systems. With Robotic Process Automation, the systems will manage the process precisely and efficiently. Also, the voluminous data and processes can be effectively managed with the newest form of technological advancements like AI and Machine Learning.

Not to forget, RPA solutions can’t be hindered by data outages and are available 24*7. Also, the data is backed up efficiently, frequently, and automatically. So, if any unfortunate circumstances arise, it will be for a minimal time, and the process will continue seamlessly soon after.

Extract Information with Accuracy

Most of the bank's financial processes are handled with high precision and security. However, human errors are inevitable, and with vast volumes of customer data stored in systems, it can be challenging to identify the relevant data and interpret them precisely to address this challenge and enhance the resilience of identity and access management (IAM), consider implementing AcSense's powerful IAM resilience platform.

So, RPA, an amalgam of technologies like Artificial Intelligence and Machine Learning, can easily store crucial information for any requested query in the ocean of stored customer data in systems. Also, when there are discrepancies or missing information on invoices, automated processing uses third-party databases to collect information to optimize Account Receivable concisely and Accounts Payable processes.

However, with RPA and especially Intelligent Automation, these processes can be done in minimal time.

Without any ado, let’s look at the most automated processes in the banking industry that have undergone digitization with automation.

“According to Grand View Research, the banking and financial services sector were leaders of RPA adoption in 2019, accounting for approximately 29% share of the global revenue”.

Future of RPA in Banking and Finance

Emerging Trends in RPA and Machine Learning

-

Increased Adoption of Cloud-Based RPA: Cloud-based RPA solutions are set to gain popularity due to their greater flexibility, scalability, and cost-effectiveness. Financial institutions can leverage cloud-based RPA to quickly scale their automation efforts without the need for significant upfront investments in infrastructure.

-

Integration with Artificial Intelligence (AI) and Machine Learning (ML): The integration of RPA with AI and ML will enable more complex automation, predictive analytics, and decision-making. This combination, often referred to as intelligent automation, will allow financial institutions to automate processes that require cognitive capabilities, such as understanding natural language and making data-driven decisions.

-

Rise of Intelligent Automation: Intelligent automation, which combines RPA with AI and ML, will become more prevalent. This will enable financial institutions to automate more complex processes, such as fraud detection and risk management, and make more informed decisions based on real-time data analysis.

-

Growing Importance of Cybersecurity: As RPA adoption increases, ensuring the security and integrity of automated processes will become a top priority. Financial institutions will need to implement robust cybersecurity measures to protect sensitive data and prevent cyber threats.

Future of RPA in Financial Services Industry

The future of RPA in the financial services industry is bright, with RPA expected to play a critical role in transforming financial operations. Financial institutions will continue to adopt RPA to:

-

Improve Operational Efficiency: RPA will help financial institutions streamline processes, reduce manual errors, and increase productivity. By automating repetitive tasks, employees can focus on more strategic and value-added activities.

-

Enhance Customer Satisfaction: RPA will enable financial institutions to provide faster, more accurate, and personalized services, leading to improved customer satisfaction. Automated processes can handle customer inquiries and transactions more efficiently, resulting in a better overall customer experience.

-

Reduce Operational Costs: RPA will help financial institutions reduce operational costs by automating repetitive tasks and minimizing manual labor. This will lead to significant cost savings and allow institutions to allocate resources more effectively.

-

Ensure Regulatory Compliance: RPA will help financial institutions ensure regulatory compliance by automating compliance-related tasks and reducing the risk of non-compliance. Automated processes can accurately gather and report data required for regulatory purposes, ensuring timely and accurate compliance.

Top RPA Use Cases in Banking

1. Customer onboarding: Automating the process of gathering customer data, verifying identities, and setting up accounts reduces costs and accelerates the onboarding process.

2. Cash management: Automating cash management processes, including cash forecasting, liquidity management, and cash position reporting, to optimize cash flows and improve overall financial management.

3. Account reconciliation: Using RPA to automate the reconciliation of accounts, such as bank accounts and credit card statements, by comparing transaction data, identifying discrepancies, and generating reconciliation reports, improving accuracy and reducing manual effort.

4. Data migration: Leveraging RPA to automate the migration of data from legacy systems to new platforms during system upgrades or integration projects, ensuring data integrity and minimizing the risk of errors.

5. Compliance: Using RPA to gather data from various sources, such as government websites and news outlets, to ensure compliance with regulatory requirements, saving time and reducing manual effort.

6. Loan processing: Automating loan administration processes, including underwriting, validation, and data consolidation, to streamline the loan approval process and improve efficiency.

7. Customer service: Utilizing RPA-powered chatbots to handle low-priority customer queries, such as balance inquiries and mortgage application status checks, improving response times and customer satisfaction.

Accounts payable: Automating invoice processing tasks, including data extraction, validation, and payment initiation, reducing manual effort, improving accuracy, and simplifying compliance reporting.

-

Credit card processing: Approving credit card applications by automating identity verification, background checks, and decision-making processes, resulting in faster application processing and improved customer experience.

-

Fraud detection: Using RPA tools to continuously monitor customer transactions, detect anomalies based on rule-based systems, and flag potentially fraudulent activities for further review by human employees.

-

Know your customer (KYC): Automating rule-based processes for setting up, validating, gathering, and compiling customer data. This approach speeds up and simplifies the KYC process while minimizing disruptions to existing systems. For an effective solution that enhances these automated processes and ensures compliance with regulatory standards, consider top using KYC software solutions that address these needs.

-

Account closure: Automating sequential tasks involved in account closure, such as document validation, updating internal systems, and sending relevant notifications, freeing up employees for more valuable tasks.

-

General ledger: Automating account reconciliation processes, including data gathering from multiple systems, payment validation, loan verification, and general ledger account reconciliation, reducing errors and saving time.

-

Trade settlement: Automating trade settlement processes by extracting relevant trade data, matching confirmations, validating settlement instructions, and generating reports, improving accuracy and speeding up settlement processes.

-

Risk assessment and management: Utilizing RPA to automate data collection, risk modelling, scenario analysis, and reporting to enhance risk assessment and management practices.

-

Mortgage underwriting: Streamlining the mortgage underwriting process by automating document collection, data extraction, credit scoring, income verification, and compliance checks, improving efficiency and accuracy.

-

Wealth management operations: Automating various wealth management operations, including client onboarding, investment portfolio rebalancing, account maintenance, and performance reporting, improving operational efficiency and enabling personalized services.

-

Regulatory reporting: Automating the gathering, analysis, and reporting of data required for regulatory compliance, ensuring timely and accurate reporting while reducing the risk of non-compliance.

Finally, you must be wondering how to implement RPA in banking and finance.

Here’s the answer!

How to Implement RPA in Banking and Finance?

Our internal RPA experts at Signity Solutions recommend following these steps to implement Robotic Process Automation (RPA) in finance and banking:

-

Identify manual and repetitive tasks for automation:

- Analyze your finance and banking processes to identify tasks that are performed manually and are repetitive in nature.

- Examples include data entry, account reconciliation, report generation, invoice processing, and data migration.

-

Define clear goals and objectives for RPA implementation:

- Clearly define the outcomes you want to achieve through RPA, such as reducing errors, improving efficiency, enhancing compliance, or increasing operational speed.

- Align these goals with the broader strategic objectives of your organization.

-

Select a suitable RPA tool (e.g., UiPath, Automation Anywhere):

- Evaluate different RPA tools based on factors like features, scalability, integration capabilities, ease of use, and vendor support.

- Choose a tool that best meets your organization's requirements and budget.

-

Assess process feasibility and prioritize based on volume and stability:

- Evaluate each identified process for its suitability for automation. Consider factors like process stability, rule-based nature, transaction volumes, and system compatibility.

- Prioritize processes that have high volume, repetitive tasks, and minimal exception handling.

-

Design detailed workflows and process maps:

- Map out the entire process flow using a process flow diagram, including the input data sources, desired outputs, decision points, and system interactions.

- Clearly define the steps that the software robot will take to complete the task, including data extraction, manipulation, and validation.

-

Develop and test automation scripts using the chosen RPA tool:

- Use the selected RPA tool to develop automation scripts based on the defined workflows.

- Test the scripts thoroughly in a controlled environment to ensure they work as expected and handle exceptions appropriately.

-

Obtain necessary approvals from stakeholders:

- Seek approvals from relevant stakeholders, such as compliance, IT, and management, to ensure alignment with organizational policies and regulations.

- Address any concerns or risks associated with data security, regulatory compliance, or operational impact.

-

Implement scripts and closely monitor their performance:

- Deploy the automation scripts to the production environment and closely monitor their performance.

- Continuously monitor the automated processes to ensure they are running smoothly and address any issues or exceptions that arise.

-

Provide training to employees on RPA usage and collaboration:

- Train the employees who will interact with the automated processes.

- Help them understand the changes brought by RPA and provide guidance on how to collaborate effectively with the software robots.

-

Scale automation to additional processes gradually:

- Once you have successfully implemented RPA in a few processes, gradually scale it to automate additional finance and banking operations.

- Continuously assess and identify new processes that can benefit from automation.

-

Continuously optimize and refine automated workflows:

- Collect performance metrics and feedback to identify areas for improvement.

- Refine the automated workflows to optimize efficiency and address any issues or bottlenecks.

-

Look for opportunities to leverage cognitive technologies:

- Explore the integration of cognitive technologies like natural language processing or machine learning to enhance automation capabilities further.

- These technologies can enable intelligent decision-making and advanced data analysis within automated processes.

-

Align RPA initiatives with organizational goals:

- Ensure that the RPA initiatives align with the broader strategic goals of your organization.

- Regularly review and realign RPA implementation to maximize its impact on improving finance and banking operations.

Finally, RPA in banking and finance is a continuous process. You can’t automate everything at once, but it’s a good point to start selecting your initial topic carefully.

The future of RPA in banking is only going to continue to grow as organizations realize financial transformation. According to Deloitte’s Global RPA Survey, 78% of businesses that have already implemented RPA will continue to grow their investment over the next three years.

Revolutionize Banking Operations with RPA Excellence

Transform operations & boost productivity!

Get custom RPA solutions tailored for banking success.

So, to make your business thrive in the long term, explore and discuss with your trusted RPA partner like Signity Solutions and start small with concrete sub-processes.

And after the most tedious tasks are automated, you can move at your own pace toward full automation.

Frequently Asked Question

Have a question in mind? We are here to answer.

What are the key benefits of implementing RPA?

![]()

The benefits of integrating RPA in Business are listed below:

- Increased Productivity. Most RPA robots are designed to focus on performing specific routine tasks.

- Increased Efficiency.

- Enhanced Accuracy.

- Increased Security.

- Boost in Scalability Opportunities.

- Improved Analytics.

- Enhanced Customer Service.

- Non-disruptive.

Why is RPA important in banking?

![]()

What are the benefits of robotic accounting and RPA in finance operations?

![]()

There are numerous benefits of RPA in finance operations. A handful of them are listed below:

- Fewer Costs, More Revenue. Robotic process automation enables a business to speed up transactions with fewer errors.

- Non-invasive Integration.

- 24/7 available With Zero Error.

- Value Creation.

- Easy Installation.

- Public Accounting.

- Reconciliation and Analytical Tasks.

- Dual-Purpose Audit Tests.

What is an example of RPA implementation in the banking sector?

![]()

What is RPA in finance?

![]()

![12 RPA Use Cases In The Real World [Updated 2024]](https://www.signitysolutions.com/hs-fs/hubfs/Imported_Blog_Media/RPA-Use-Cases-1024x512.png?width=352&name=RPA-Use-Cases-1024x512.png)